Things about Kam Financial & Realty, Inc.

Table of ContentsThe smart Trick of Kam Financial & Realty, Inc. That Nobody is DiscussingNot known Details About Kam Financial & Realty, Inc. The Buzz on Kam Financial & Realty, Inc.Kam Financial & Realty, Inc. Things To Know Before You Get ThisWhat Does Kam Financial & Realty, Inc. Do?Rumored Buzz on Kam Financial & Realty, Inc.

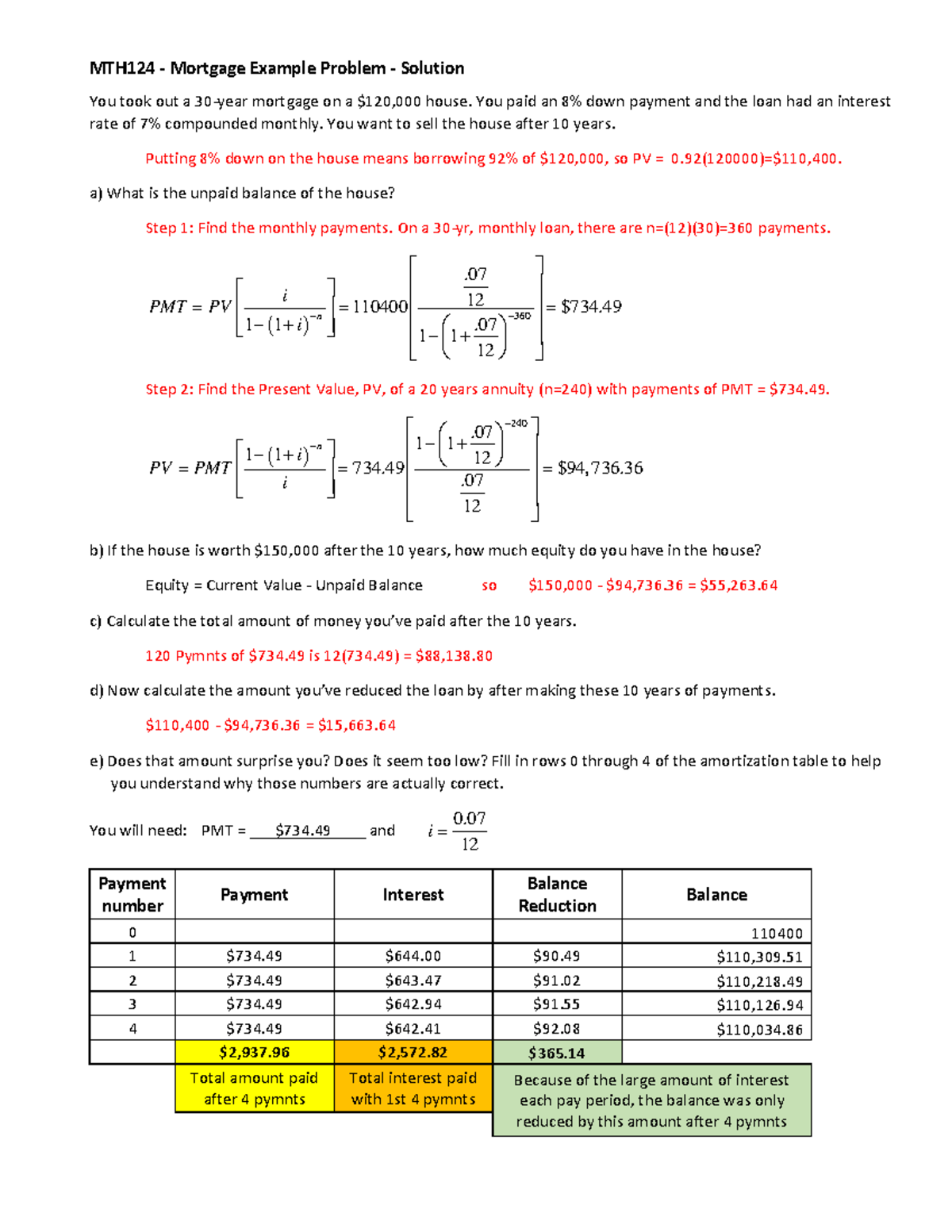

A home loan is a car loan made use of to buy or preserve a home, story of land, or other actual estate.Home loan applications undergo an extensive underwriting process prior to they reach the closing stage. Mortgage types, such as traditional or fixed-rate financings, vary based on the customer's requirements. Mortgages are finances that are used to get homes and other types of realty. The residential or commercial property itself works as security for the funding.

The expense of a home mortgage will certainly depend on the type of financing, the term (such as thirty years), and the passion price that the lender costs. Home mortgage rates can differ widely depending upon the kind of item and the credentials of the candidate. Zoe Hansen/ Investopedia Individuals and companies use mortgages to acquire property without paying the entire purchase cost upfront.

The smart Trick of Kam Financial & Realty, Inc. That Nobody is Talking About

A lot of traditional home loans are fully amortized. Normal mortgage terms are for 15 or 30 years.

As an example, a residential property buyer promises their residence to their loan provider, which after that has an insurance claim on the residential or commercial property. This guarantees the loan provider's rate of interest in the building must the buyer default on their economic commitment. When it comes to repossession, the lender may kick out the citizens, market the residential property, and utilize the cash from the sale to pay off the home loan debt.

The lender will request for proof that the borrower is qualified of repaying the lending. This might consist of bank and financial investment declarations, recent income tax return, and proof of present work. The lending institution will generally run a credit check as well. If the application is approved, the lender will supply the debtor a funding of as much as a specific amount and at a specific interest price.

8 Easy Facts About Kam Financial & Realty, Inc. Described

Being pre-approved for a home loan can give customers a side in a tight real estate market due to the fact that sellers will certainly know that they have the cash to back up their deal. As soon as a buyer and vendor settle on the regards to their deal, they or their agents will fulfill at what's called a closing.

The seller will certainly move ownership of the home to the purchaser and receive the agreed-upon amount of money, and the buyer will certainly authorize any type of remaining home mortgage files. There are hundreds of options on where you can obtain a home loan.

Kam Financial & Realty, Inc. Things To Know Before You Buy

The conventional type of home loan is fixed-rate. A fixed-rate home loan is also called a conventional home over at this website loan.

Kam Financial & Realty, Inc. Fundamentals Explained

The whole finance equilibrium comes to be due when the borrower passes away, moves away completely, or sells the home. Points are basically a cost that customers pay up front to have a reduced rate of interest price over the life of their funding.

Kam Financial & Realty, Inc. Things To Know Before You Get This

Just how much you'll need to spend for a home mortgage relies on the type (such as fixed or adjustable), its term (such as 20 or three decades), any kind of discount rate factors paid, and the rates of interest at the time. mortgage lenders california. Rate of interest prices can vary from week to week and from lender to lending institution, so it pays to look around

If you default and foreclose on your home mortgage, however, the financial institution might become the new owner of your home. The rate of a home is commonly far more than the quantity of money that most households conserve. Consequently, home loans enable people and households to buy a home by taking down only a fairly small deposit, such as 20% of the purchase cost, and obtaining a financing for the equilibrium.

Comments on “Unknown Facts About Kam Financial & Realty, Inc.”